Beating the Index

It is much harder to beat the index and index funds is the answer

For a long time, India was the haven for active investing.

There were a large number of promising mid-cap and small-cap stocks.

Large caps were underpriced and fund managers had enough options to pick and choose stocks to beat the market.

Investors often used to wonder how fund managers could consistently outperform equity indices in India when global fund managers were struggling.

That trend appears to be coming to India too; as per Morningstar.

Tougher to beat the index

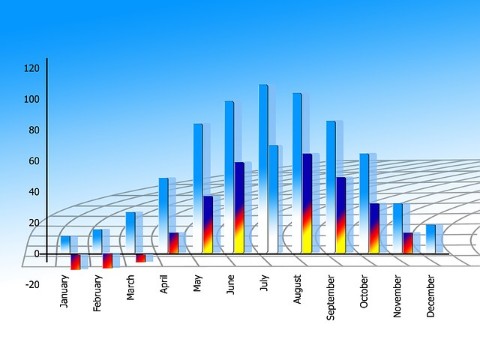

If you took any equity fund and look at long period returns and then break it up into 5-year time frames, the results will be surprising.

You will find that in the five years since 2014, funds have literally struggled to beat the index.

Consider some statistics of the Indian equity large-cap funds for the calendar year 2018.

The difficulty in outperformance was most pronounced in the large-cap category.

For example, over a 1-year time frame, 92% of the funds failed to beat the indices as per a study by SPIVA.

If you extend that investment time frame from 1 year to 3 years, 90% of the funds still failed to beat the index.

That is a little more disconcerting.

If you consider a slightly longer time frame of 5 years and 10 years, you will still find that over 60% of the fund managers are still finding it hard to beat the index.

To that extent, mutual fund investing is more like tossing a coin. What does that mean?

Assets are converging

The big shift that happened in the last few years is that markets are becoming more of a beta market and less of an alpha market.

The synchronized monetary policy followed by central banks across the world has led to assets across classes and also assets within classes converging a lot more.

As a result, most of the market risks and the market opportunities are reflected adequately by the index itself.

It is going to be very hard for fund managers to consistently beat the index, even in India.

A bigger dilemma it will be for investors.

When 90% of the fund managers have failed to outperform the indices in the last 3 years, what is the probability that the investor can select a fund manager who can outperform?

It is actually as low as 10%.

That is where passive allocation becomes a lot more relevant.

Look for passive opportunities

If you have been wondering as to why index funds are such a big attraction in Western countries, this is why.

It is practically very hard to beat the index on a consistent basis.

But it is a lot more difficult for investors to identify such funds that can beat the indices on a consistent basis.

A simpler answer would be opting for index funds or index ETFs.

Over a 3 year period, you know for sure that you stand a 90% chance of doing better than active funds. That passive trend is finally coming.

0 Comments